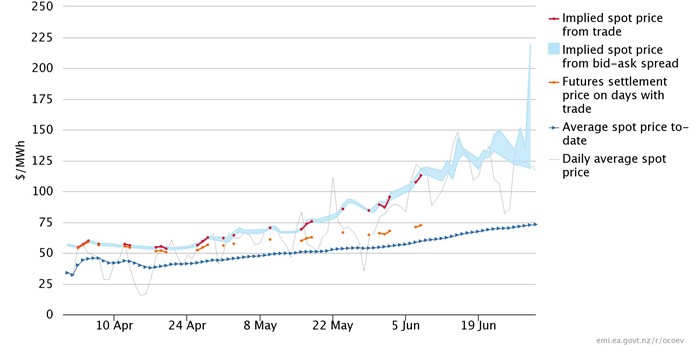

The traded price of a futures contract provides insight into the market's expectation of the spot price for the contract period. A quarterly futures contract begins to trade about three years before the contract period begins and remains able to be traded right up until the contract period ends and the contract expires (monthly contracts become available about six months before the contract period). Settlement occurs several days after the expiration date. During the contract period, the price at which the contract trades (orange line) will take into account the information already known about the spot price to-date (blue line) and the market’s expectation of the spot price for the remainder of the contract period. This new report derives the implied spot price for the remainder of the contract period from the bid-ask spread (blue area) and trade (the red line) within the contract period.

An example for a contract at Otahuhu, Q2 2017, shows a situation where the market is expecting the spot price to rise during the contract period. If you move your cursor over the chart you’ll highlight a single day; everything to the left of this is known on this day, and everything to the right is unknown. The average spot price to-date (blue line) is the simple average of the half-hourly spot price from the beginning of the contract period at the selected location. A trade (or a willingness to trade) above the average spot price to-date suggests the market expects, or is implying, that the spot price for the remainder of the contract period will be higher than the average so far. The degree to which this trade price is above the average spot price to-date lets us derive the implied spot price for the remainder of the contract. Clearly, the opposite also applies, with a trade price below the average spot price to-date implying a lower spot price is expected for the remainder of the contract. Contracts are settled as a Contract for Differences (CfD) after contract expiry. Holders of a contract at expiry that was purchased at a price above the average spot price (the last blue data point) will owe money to the exchange. Conversely, holders of a contract purchased at a price lower than the average spot price will receive funds from the exchange.

Implied spot price - Otahuhu, Q2

Trade in New Zealand electricity futures tends to be relatively light during the contract period. We have included the settlement price (orange line) only on days when a trade occurs, and have derived the implied spot price (red line) from this trade price. In addition, we have derived the implied spot price range (shaded blue region) that is indicated by the bid-ask spread for the contract, as this ‘willingness to trade’ still provides insight into the market's expectation of spot prices for the remainder of the contract. The settlement price (orange line) and the average spot price to-date (blue line) generally converge as the contract period progresses and uncertainty diminishes regarding both the average spot prices for the contract period (there remains less time that the spot price is unknown) and the future spot price (there exists greater certainty about near-term spot prices).

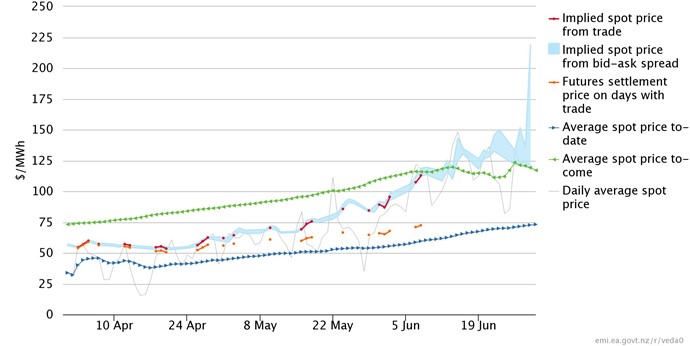

We include a series for the ‘average spot price to-come’ (green line) once the contract is complete (we can’t see the future either!). This series allows a comparison between the market's expectation of the spot price for the remainder of the period and what the realisation of this expectation turned out to be. Generally, as the contract period progresses, the implied spot price from trade (red line) and the average spot price to-come (green line) will tend to converge when the market's prediction is correct. If the implied spot price from trade (red line) on any day is lower than the average spot price to-come (green line), then the purchaser (and holder) of the futures contract will receive money when the contact is settled by the exchange.

Implied spot price - Otahuhu, Q2 (The red data points are the market prediction of the green data point on the same day.)

Click through to see the implied spot price for the remainder of the current contracts (or follow the public dashboard).