This report includes aggregate measurements of the number of New Zealand electricity futures contracts available to be traded at any point in time throughout the ASX trading sessions. Depth is currently provided via the market-making activities of the four largest generators in the New Zealand wholesale electricity market. The most recent voluntary market-making arrangements came into effect on 13 January 2020. A more enduring and mandatory Code obligation on these current market makers to provide ongoing market-making services is currently being consulted on.

ASX24 market data is used to assemble the market depth report. This data allows us to construct minute-by-minute snapshots of the order book. From these snapshots we are then able to measure the depth of the order book at any point during the trading session. Users can see how the available depth has changed over time, and contrast the depth with the level of service provision emanating from the market-making arrangements that have evolved over time. When hovering on a specific point in the chart, tool tips report a detailed count of available quotes, or orders. Additional information about market-making performance and obligations can be gleaned from our market making performance report.

The market depth report is accompanied by explanatory notes under the more information report tab.

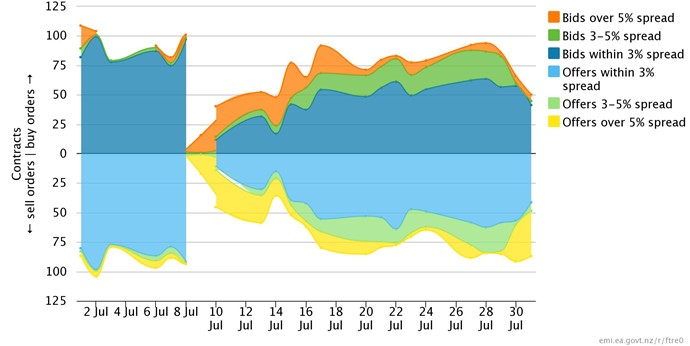

Users can see how the available depth of quarterly contracts during the market making session (all of which are included in market-making requirements) have varied over time. Following an urgent Code amendment in January 2020, we can see how the depth within a 3% spread changed as market makers complied with the new spread requirement.

New Zealand Aluminium Smelters Ltd announced their intention to exit the market on 9 July 2020. On that day, and in the days that followed, the available market depth dropped significantly before slowly rebuilding in the subsequent weeks. All market makers elected to exercise their right to be exempt from market-making obligations for up to five days per month on 9 July 2020. The market depth report can be used to examine depth during this period. Even though trading volumes were quite high during this period as orders were traded out, market depth was particularly low.