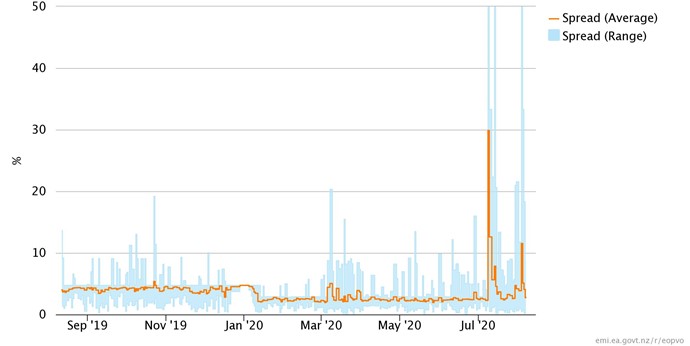

This new report includes aggregate measurements of the bid-ask spread of New Zealand electricity futures contracts throughout the trading session on the ASX platform. The bid-ask spread of quotes made through market-making arrangements are regulated; currently these cannot exceed 3% for market-made quotes. The most recent voluntary market-making arrangements came into effect on 13 January 2020 with a mandatory backstop Code obligation introduced on 3 February 2020.

This is the first report the Authority has published which makes use of ASX24 market data. This data allows us to construct snapshots of the order book and the bid-ask spread between the two best quotes at any point during the trading session. Using these snapshots at a minute-by-minute resolution over the trading session allows us to calculate an average spread value and a range of spread values for selected instruments. Users can see how the spread of futures contracts has behaved at different points of time at the level of service provision included in market making arrangements. When hovering on a specific day in the series, users can see the number of market makers who were providing services on that day. For more information about market-making performance and obligations see our market making performance report and our recent market commentary.

Users can see that long-dated (expiring in more than a year) quarterly contracts were particularly affected on 9 July 2020, the day that NZAS announced their intention to exit the market. The average spread of these contracts was nearly 30%, as all market makers used their ability to opt out of market making on that day.