An interesting situation occured in trading periods 37 and 38 on 23 April 2018.

Nova Energy's McKee plant in Taranaki (MKE1101 MKE1) suffered an unexpected cessation of gas supply after gate closure but before real time. The plant had been offered in to the market to the tune of 46MW at $250/MWh. When it was realised that no gas would be available, the plant operator needed to take the plant out of the market using a bona fide offer revision. However, the offer revision was accomplished by erroneously increasing the offer price from $250/MWh to $2500/MWh, when in fact the operator should have decreased the MW from 46 to zero.

When final prices were calculated the next day, the McKee plant was the marginal unit in trading period 37 and therefore set the price. McKee was not the price-setting plant in trading period 38. As an aside, figuring out the price setter in trading period 38 gets complicated due to the interaction of the energy market with the reserve market as well as reserve sharing across the islands; hence we won't distract from the point of this post by explaining it.

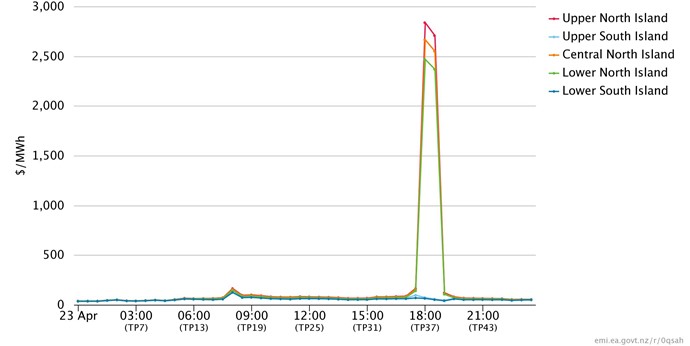

As can be seen in the figure below, prices jumped up to about $2500/MWh or more throughout the North Island in trading periods 37 and 38. Although to be clear, these high prices were correct in trading period 38.

Interim final prices for 23 April 2018

The SPD run that generated these prices has been replicated using vSPD-online – see the job called FP_20180423_TP37_TP38. In addition, another vSPD-online job called FP_20180423_TP37_38_McKee_0MW has been run that correctly modifies the offer for the McKee plant, i.e. rather than set the price to $2500/MWh, the offered megawatts have been changed from 46 to zero.

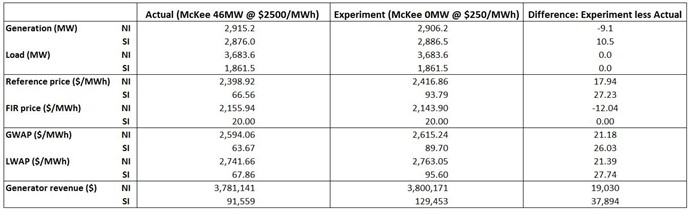

The output of both of these model runs can be downloaded and analysed. Key results are presented in the table below. The job called FP_20180423_TP37_TP38, which resulted in the actual interim prices published for 23 April, is referred to as Actual (McKee 46MW @ $2500/MWh) in the table below whereas the experiment, or the job called FP_20180423_TP37_38_McKee_0MW, is referred to as Experiment (McKee 0MW @ $250/MWh).

Selected vSPD-online results for trading period 37, 23 April 2018

As can be seen in the results, had McKee not been the price setter, the next plant in the merit order would have been called upon and prices would have been slightly higher. When McKee's offer was modified correctly, the North Island reference price turned out to be $17.94/MWh higher whereas the South Island reference price was $27.23/MWh higher. Similar price differences can be seen in the generation-weighted average price (GWAP) and load-weighted average price (LWAP) for both islands. These increased prices are partially offset by a lower fast instantaneous reserve (FIR) price in the North Island.

The overall impact of this error is that generators are left short by almost $57,000 – about $19,000 in the North Island and almost $38,000 in the South Island.

The Compliance team at the Authority is now investigating. In the meantime, the Authority has claimed a pricing error relating to trading period 37 on 23 April 2018. Resolution of that claim is also working its way through the system.

One issue that this event has brought to the fore is the practice of using a high offer price to take a plant out of the market when the plant is unavailable for a short period (rather than not offering the plant at all at any price). As this event has shown, the high offer price may not be sufficient to ensure the plant is not called upon to be dispatched.

We will keep you posted as to how this turns out.